Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

An asset retirement obligation (ARO) is a legal obligation that is associated with the retirement of a tangible, long-term asset. It is generally applicable when a company is responsible for removing equipment or cleaning up hazardous materials at some agreed-upon future date.

A company must realize the ARO for a long-term asset at the point an obligating event takes place, so their financial statements accurately reflect the company’s value.

The purpose of asset retirement obligations is to act as a fair value of a legal obligation that a company undertook when it installed infrastructure assets that must be dismantled in the future (along with remediation efforts to restore their original state). The fair value of the ARO must be recognized immediately, so the present financial position of the company is not distorted; however, it must be done reliably.

AROs ensure that known future problems are planned for and resolved. In the real world, they are utilized mainly by companies that typically use infrastructure in their operations. A good example is oil and gas companies .

ARO calculations are governed by the Financial Accounting Standards Board’s Rule 143. The rule essentially states that a company has a legal obligation to remove the asset, and there are certain calculation rules for an accountant to follow.

When a company installs a long-term asset with future intentions of removing it, it incurs an ARO. To recognize the obligation’s fair value, CPAs use a variety of methods; however, the most common is to use the expected present value technique. To use the expected present value technique, you will need the following:

Acquire a credit-adjusted, risk-free rate to discount the cash flows to their present value. The credit rating of a business may affect the discount rate.

When calculating the expected values, we need to know the probability of certain events occurring. For example, if there are only two possible outcomes, then you can assume that each outcome comes with a 50% probability of happening. It is recommended you use the probability distribution method unless other information must be considered.

Then, you can follow the steps to calculate the expected present value of the ARO:

1. Estimate the timing of the future retirement costs (cash flows), along with their respective amounts.

2. Determine an appropriate discount rate based on the businesses’ credit rating and an underlying risk-free rate. You can use the Capital Asset Pricing Model (CAPM) to find the appropriate discount rate.

3. Recognize any period-to-period increases in the ARO carrying amount (it is like an accretion expense). You can do it by multiplying the beginning balance of the liability by the original credit adjusted, risk-free rate.

4. Recognize upward liability revisions – discount any costs that may be incurred in the future that you did not originally account for.

5. Recognize downward liability revisions – remove the discounted effect of any costs that might have been overstated in your original estimate.

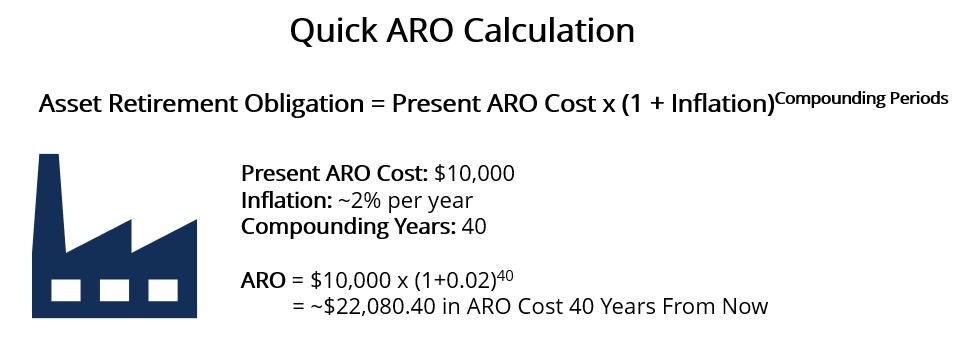

If you are seeking a rough estimate, you can usually acquire it by accounting only for inflation. For example, if you hold a 40-year lease on a piece of land, the cost of the ARO today is $10,000, and you expect inflation to run at 2% per year, then:

The $22,080.40 is the approximate fair value that a company will need to spend when retiring the asset in 40 years.

A company should periodically review its AROs to account for upward or downward liability revisions. During the review, the company should use an updated discount rate that reflects current market conditions. Follow the steps below to assist in the recognition of any additional costs an ARO’s undertaken since original recognition:

1. Recognize the future costs (the liability) at fair value.

2. Allocate the ARO liability over the lifetime of the long-term asset.

3. Measure changes to the ARO (the liability) with the passage of time, using the original discount rate when each liability layer was recognized. It will be reflected in the differing balance on the balance sheet.

4. As time passes, the probabilities and amount that are associated with the ARO will improve in predictive accuracy. As such, you should continuously look at whether to adjust the liability upwards or downwards.

If you adjust upwards, use the current credit adjusted, risk-free rate to discount it. If you adjust downwards, use the original credit adjusted, risk-free rate.

An individual will usually carry out a subsequent measure of an ARO when a portion of the liability must be paid before the asset retires. If there is no expense associated with retiring the asset, then they can write down the ARO to 0.

CFI offers the Commercial Banking & Credit Analyst (CBCA)™ certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.